Marc

Customer Advocate

The Customer Advocate takes ownership of assigned clients and be the lead in the resolution of their issues. The Customer Advocate works within their assigned groups to deliver exceptional customer service. This professional represents customers’ interests in company meetings, collaborate with the internal departments to resolve customer requests and issuesand contribute to the generation of new services and features to improve customer experience and customer satisfaction

Volume 17, Issue 1

|

||||||||||||||||

|

||||||||||||||||

|

St. Lucia Workers’ Credit Union Ltd launches its Contactless VISA Card!

Left: Mr. Peter Lewis - President; Right: Ms. Charmain St Remy - General Manager

Micro Software Designs Ltd is pleased to advise that our customer, the St. Lucia Workers’ Credit Union Ltd, officially launched its Contactless VISA Card on 30th June 2021 at their head-quarters at Bourbon St, Castries, St Lucia.

The Contactless St. Lucia Workers’ Credit Union VISA Card, which is powered by the Bank of St. Lucia is a historic collaboration between the two local financial partners. The collaboration dubbed “a world of possibilities in your pocket” will provide a faster, safer and more secure means of conducting payments in person, online, overseas when travelling and over the phone using the Contactless VISA Card.

Members of the St Lucia Workers’ Credit Union will benefit from the extended convenient services including access to all Bank of St. Lucia ATMs and one million ATMs worldwide, acceptance in more than 200 countries and territories and the ability to access funds from anywhere VISA is accepted.

MSD is indeed pleased to be part of this project and to collaborate once again with the other vendor Digital Cash Processing (DCP) in making this a reality.

Best wishes to the Board, Committees, Management and Staff of the St. Lucia Workers' Credit Union Ltd for achieving another milestone in your digital transformation.

Tech News

Have you noticed the cost of certain computer components seem to be less available and more expensive than it was in the past and how difficult it is to purchase the latest generation video game consoles? This is not a coincidence but instead it is the effect of a global semiconductor (aka microchip) shortage on downstream manufacturers. You will find it hard to name much new electronic devices that do not use a chip of some kind - from new major appliances to new vehicles.

Two things are the likely cause of this and both of them have to do with the Covid-19 pandemic. The first is the cut in production by many chip suppliers that slowed their factory output after implementing measures to survive the pandemic. The other is the increase in the demand for these chip-using devices, some think it is because of the increase in buying by persons in lockdown who may have extra cash to spend. This low production – high demand problem also opened the door for a new technology scalping and resale business, which is causing frustration among desperate legitimate consumers.

The top three semiconductor-manufacturing firms in the world are TSMC of Taiwan, Samsung of South Korea, and Intel of the United States1 and while they have implemented plans to alleviate the supply-demand imbalance experts say that it may take up to two years for that to happen. Some countries are addressing this scarcity that inhibits innovation more seriously. The US President Joseph Biden said last week, “The American people should never face shortages in the goods and services they rely on...We shouldn’t have to rely on a foreign country to protect and provide for our people.” as he signed an executive order to do something about it2.

1Wikipedia, Semiconductor Industry

2Daly, J. March 9, 2021 A big little problem: How to solve the semiconductor shortage

Watchlist Checking

MSD was invited to present on the topic "Watch List Checking....it is not as difficult as you think!" at the TECH AML 2021 Anti-Money Laundering Virtual Conference hosted by NEM Leadership Consultants, held on March 16th - 17th 2021. We were able to demonstrate to attendees from around the Caribbean; the ease at which the search can be done based on the seamless integration between Emortelle and the Dow Jones database.

The quality of the data retrieved was impressive and some enquired how often the data was updated on the Watchlist; which is done weekly. Apart from unlisted persons, searches were done on known terrorists, Politically Exposed Persons, names of persons on the Trinidad and Tobago Consolidated List of Court Orders and companies suspected to be on Official or Sanctions list within Emortelle to demonstrate accuracy and speed in locating these in the Watchlist. It was shown that the System can detect layering when deposits are made and the automatic generation of the Declaration of Source of Funds. Additionally, detection of listed persons at on-boarding and deposit taking was shown to result in email notifications to the Compliance Officer.

MSD was pleased to be part of this event and this is what Mr. Nigel Matthew, CEO of NEM Leadership Consultants had to say, "The Caribbean Anti Money Laundering Virtual Conference 2021 with the theme AML … A Strategic Priority has fulfilled its objectives by bringing insights into making the compliance function A Strategic Priority. The different topics were extremely well delivered by all knowledgeable speakers from the Caribbean. Attendees appreciated the discourse and concluded that AML should in fact be treated as A Strategic Priority since Financial crimes are posing major challenges for financial institutions and other listed businesses. As one of the attendees said at the end of the Conference- It was insightful and a pleasure to see our Caribbean counterparts expressing what they are experiencing and showing the region's wealth of knowledge. We are rated as high risk, but our efforts surpass many!”.

MSD therefore urges our customers to ensure that they make AML a strategic priority.

MSD recognize that Watchlist checking is a function that may be tedious for some Financial Institutions who do not have an integrated Application. We have conducted a survey with such entities to ascertain their interest in using an online screening facility which will include the ability to display the screening results into a database, which will afford future opportunities to search same names and produce tailored reports. We assessed that a database will be an advantage for these organizations to track searches (last date looked up) for their customers in order to fulfill their AML mandate. We will keep you posted, interested Non-Emortelle organisations can always email to This email address is being protected from spambots. You need JavaScript enabled to view it..

Some customers have reached out to us regarding customisations to automate and enhance Transaction Monitoring within the System based on their specifications. We believe that these customisations may be beneficial to other customers and we will conducting webinars to apprise you of these changes. Do let us know if you are interested by advising your Advocate.

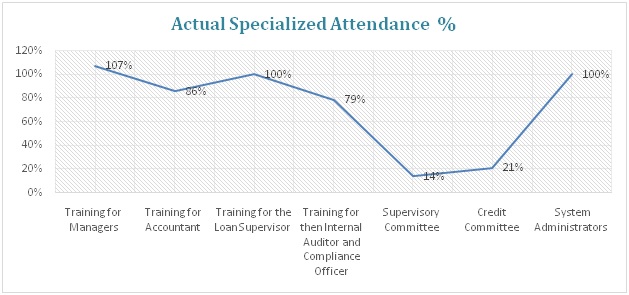

MSD - Virtual Training 2021

Consistent with MSD’s core values of quality service, efficiency and effectiveness; service excellence; high standards, we persevered to offer our calendar of training which you have come to expect. The unfortunate "appearance" of COVID-19 challenged us to re-think our methodologies and the training was held virtually using the WebEx platform.

The training program targeted all Credit Unions and other financial institutions locally and regionally and included the following modules based on the results of a Training Survey held earlier this year:

Standard Training:

- Dividend/Rebate Processing with facilitator Dil-Solomon Jaggassar

- ML Post/GL and Year End Post with facilitator Gail Griffith

- Deposit Interest Management with facilitator Rae-Ann London

- IFRS9 Management with facilitator Dominic Jennings

Specialised Training:

- Training for Managers with facilitator Vashti Paul-Khan

- Training for Accountant with facilitator Collinsworth Howard

- Training for the Loan Supervisor with facilitator Collinsworth Howard

- Training for then Internal Auditor and Compliance Officer with facilitator Vashti Paul-Khan

- Supervisory Committee with facilitator Collinsworth Howard

- Credit Committee with facilitator Collinsworth Howard

- System Administrators with facilitators Warren Alexis and Ferdinand McIntosh

We strongly believe that our Virtual Training provided a cost-effective way for pre-incident planning at your financial intuition and will positively impact the quality of service you deliver to your members, resulting in improving members’ satisfaction, sustainability, loyalty, and retention.

It should be noted however, the standard modules with the exception of IFRS were under-subscribed which was not in keeping with the Survey results previously acquired. This clearly shows our commitment to serving our customers even when its not feasible to ensure our brand promise of “committed to customer satisfaction, software excellence and Integrity”

See the following comments from some clients:

Module: Dividend and Rebate Processing:

“Overall the program was very well structured and the number of participants enabled individual attention which

enabled a better understanding of the module.” – Trainee

“Great amount of information to digest” – Trainee

Emortelle Training for Internal Auditor & Compliance Officer:

“Great training. I like the categorization of preventative and detective controls” – Trainee

“The course required additional time though very informative and well delivered” – Trainee

Emortelle Training for Managers:

“Great material and support from MSD” – Trainee

“Thank you for your in-depth explanations” – Trainee

The Supervisory and Credit Committee:

“I am very thankful for the opportunity to be part of this training. It will be very useful to me and the other credit committee members. I can see the

importance of Emortelle and how it relates to the CC. I now feel more confident in asking the right questions so that I can now make better decisions when

approving loans. The presenter did an excellent job” – Trainee

“I have acquired a wealth of information that will be beneficial to my credit union and I endeavour to put into practice” – Trainee

Overall Comments from Training

“It is a privilege for us to have a partnership with MSD for such a long time during which you have always been personally available for assistance and

information. Your willingness to quickly resolve any issues that arise is always greatly appreciated. Thank you for your professionalism and positive

attitude. On behalf of the Board of Directors, General Manager and staff at TEXTEL Credit Union Co-operative Society Limited I ask that you convey our

gratitude to the entire MSD team for their support and service. We look forward to a continued productive partnership with excellent service. Thank you.”

- Maria Berahzer, President, TEXTEL Credit Union Co-operative Society Limited

As a result of the above, we are willing and able to facilitate Credit Unions and other financial Institutions who would like to be engaged in our virtual training on a "One on One" basis. You are free to contact us as we continue to cater to your individual customized needs.

MSD at the CCCU International Virtual Conference 2021

Micro Software Designs Ltd participated in the Caribbean Confederation of Credit Unions International Virtual Conference 2021 during the period Monday 21st June to Thursday 24th June 2021 as an exhibitor.

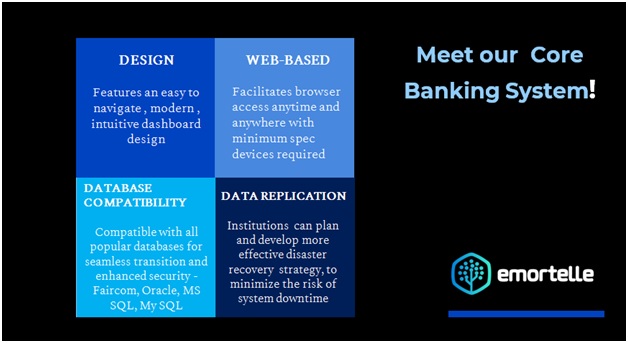

At the event we were able to showcase our new web-based Emortelle V10 Application and its digital attributes which sparked interest amongst the many who visited our virtual booth. Ev10 offers multiple database options, data replication and it is server driven which means faster and less cost.

Click here to learn more

As Dr. Spencer Thomas delivered his address on "Credit Unions in a Changing Climate" he advised, "credit unions need to embrace technology". MSD fully understands that post Covid-19, the business landscape would have changed. Businesses are quickly transforming digitally to respond to the new manner of doing business. We, at MSD are poised to provide the mechanisms to satisfy the new demands.

At this conference, MSD was able to reiterate our presence in the region as a Core Banking System provider and advise of our experience in providing quality service to our large customer base within the industry. Some of our loyal customers present at the Conference took time to visit our virtual booth and actually won prizes! Congratulations to all.

MSD looks forward to participating in next year's conference as we are of the firm belief that what matters to our customers matters to us.

Emortelle Update

MSD is pleased to present the new Emortelle logo!!!

This logo will be used in all future versions of Emortelle and we are so excited to give you this peek.

The blue represents intelligence, trust, communication and efficiency and the teal references the fact that future versions will place more emphasis on cloud hosting. The new colour blend promotes our personality and uniqueness whilst retaining true to form industry-recognised blue within our brand. We believe the colour teal being a mixture of blue and green truly represents us - a strong IT company with fresh innovative ideas and the promotion of a sustainable environment at its core

We would have indicated in earlier publications that development work had commenced on our next generation Emortelle CBS Version 10. This web-based version will be a game changer with its fresher-look GUI, multiple database options, data replication and server driven processing to name a few. It was therefore important that a new logo accompany this new innovative application.

As an update to this, we are pleased to advise that we have largely completed development and have been engaged in testing since January using external resources. We are now in a new phase of certification using internal resources and will be seeking to place in a beta test environment at a Financial Institution within the next quarter. Additionally, we have completed data replication and this has been implemented in an in-house test environment using a MySql database.

We look forward to providing more updates on this version to you soon.

© Copyright 2026 MSD

Emortelle Update

Emortelle Update  Tech News

Tech News