Volume 16, Issue 3 (4)

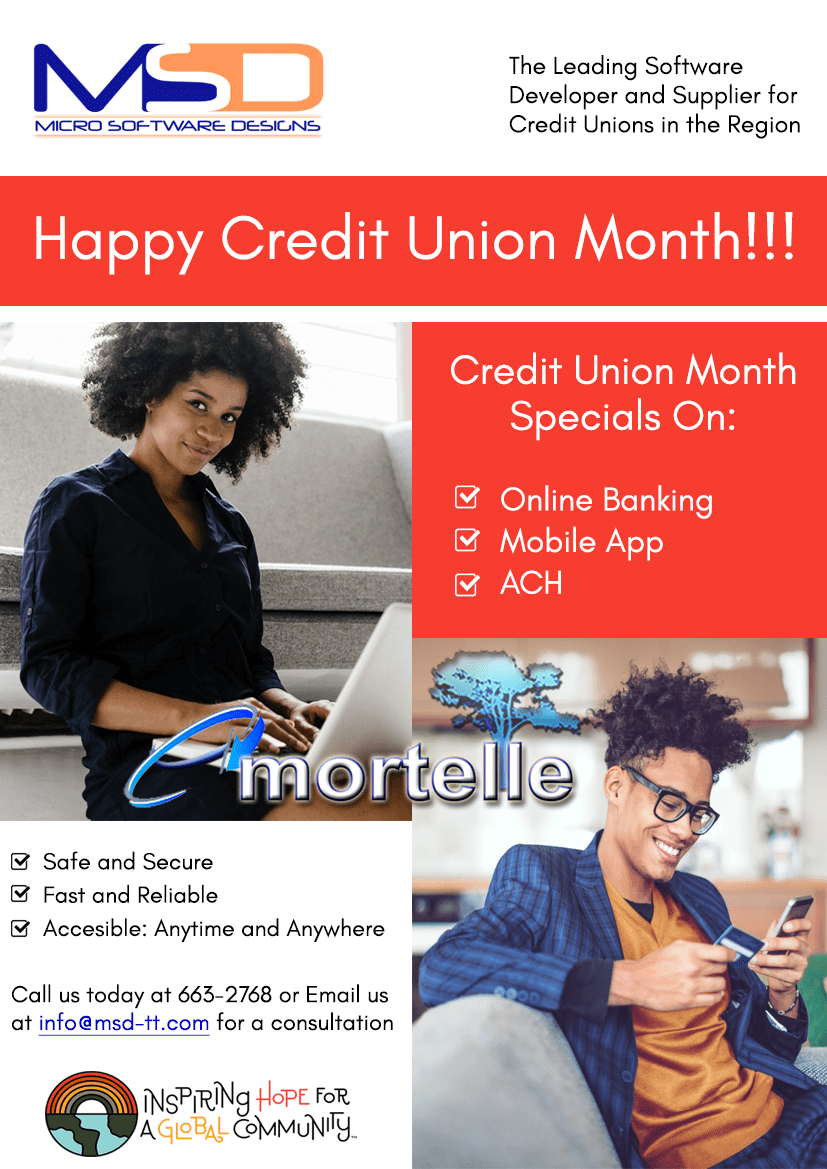

Micro Software Designs Ltd (MSD) takes pleasure in extending our best wishes to the Credit Union movement on International Credit Union Month 2020. The theme for this year's celebration is "Inspiring Hope for a Global Community" and we at MSD understand that the very nature of "Hope" will provide us with the courage to overcome the challenges of 2020 and beyond as we continue to deliver on our commitment to provide excellent customer service and sound financial solutions to you that will enhance the lives of your members.

MSD understand the impact that COVID-19 has had on our regional economies. In her keynote address at the Sixth Meeting of the Caribbean Development Roundtable held virtually on 10th September 2020, the Prime Minister of Barbados, Mia Amor Mottley, stated “Let’s be frank: the international financial system is broken. We are neither complaining nor begging. Today we are offering systemic global solutions to a systemic global problem, and I trust that our voice will be heard and we will be part of the debate. If we do not raise our voice together, we will continue to be ignored. We have a society and a civilization to defend,”

So as our regional leaders band together to rejuvenate the Caribbean economy, Financial Institutions can ascertain how best they may assist their customers given job losses and reduced income as a result of the global slowdown affecting exports, tourism, remittances and the accompanying collapse of commodity prices such as oil. Institutions may choose to reduce interest rates to make payments more affordable, increase loan period or offer deferrals/moratoriums, all of which can be accommodated in Emortelle. We have heard of some customers setting up subsidiaries to move their members into the Agriculture sector thereby offering sustainable income; whichever way you choose to support and enrich the lives of your members/customers, MSD will be there at your side to provide the financial solutions you need to drive the business.

In our previous communication to you, MSD announced that we had commenced development on its next generation Core Banking Software (CBS), Emortelle V10. We are now pleased to advise that we have completed seventy percent (70%) development work with major modules to be completed before the end of December 2020. We look forward to you embracing the new features of this web based version, which includes multilingual capability, a redesigned more attractive and friendlier user interface, with the capability of supporting multiple database types, (such as, Faircom, Oracle, MS SQL, MySQL). The new CBS will reduce PC client dependency, as it adopts a server driven approach to improve processing and other backend capabilities which support database replication. EV10 will be hosted on premises or in the cloud. Our next generation CBS, will definitely be a game changer for Credit Unions and Microfinance Institutions, in terms of reducing an institution’s overall cost, while improving the efficiency and effectiveness in the way institutions provide services to their members and clients. Our expected release date of this new version, EV10 is in the second quarter of 2021.

In closing, we reiterate the need for us to practise good hygiene and maintain our social distance as we all endeavour to control the spread of COVID-19 so that we can once again meet in person in the near future.

Remote work is a major part of this new norm we often hear about. Many people welcome the opportunity to work from the comfort of their home while some others may struggle with the change. Here are some tips that may help you master your remote work duties.

Get a morning routine. Set your alarm and start your day promptly as you would usually do when going to the office. Create a morning routine that prepares you for the day ahead. You may even want to try the last tip suggested in the list.

Dress for the job. Pick out your WFH outfit, something comfortable that follows the guidelines of your employer. For those who never turn on their camera they will have more flexibility than others.

Make yourself comfortable. Sit upright, feet flat to the floor and knees at 90 degrees. Have your elbows at right angle with hand on desktop. Try to find a quiet location to work if possible just be sure it’s not too far from your wifi router because you do not want a slow internet connection.

Use the proper tools. Using a laptop is not ideal for long hours sitting at the computer, if possible connect it to an external monitor, mouse and keyboard and be sure to elevate the screen to your eye level. If video meetings are required never sit with your back to a window with the outdoor light shining through, have adequate room lighting and pay attention to what objects (and people) are behind you. If you only do audio meetings use a good quality USB headset and if that is unavailable look into installing that meeting app on your smartphone and use your phone’s headset if available. The smartphone can also be used as your makeshift webcam on its own in the same way, be sure to prop it up on something sturdy or use a phone mount/stand/tripod.

Take breaks. Be sure to get movement breaks once every hour. Stretch, walk around, drink water and look away from your screen every now and then. Maybe improve your health, consider using the time save from no commuting to do some of that exercise that you never seem to have time for in your busy schedule.

The global pandemic has altered the process with which Financial Institutions conduct business and interact with their members/customers. Social distancing in the workplace requires that service be provided from a distance and if possible, limitations to walk in service. Emortelle is well equipped with features such as Online Banking, Mobile App and ATM Debit cards to provide account interaction and access to funds, safely, seamlessly and securely to members /customers. Let us discuss today the other Emortelle features that allows you to dispense service digitally.

This feature allows Financial Institutions to push (send) funds directly to other institutions as requested by their member/customer. These other institutions can be Commercial Banks, Billing Companies and Suppliers and the funds dispatched can be the proceeds of Loans or Savings withdrawals. Additionally, you can pay your own suppliers via the ACH feature.

The other side of this feature allows the institution to pull (receive) funds from designated accounts for the member/customer that are held at Commercial Banks, in order to satisfy their accounts held at your institution.

This feature removes the hassle of printing, signing and disbursing cheques by the institution and collecting and en-cashing cheques for the member/customer. Institutions can choose to add-on this feature to core Emortelle or through the Online Banking platform.

Institutions can send electronic statements directly from Emortelle to members/customers. All that is required is the recipient's email address stored on their account and the institution's email address credentials configured in Emortelle.

Institutions saves on cost as no paper, printer, envelop or postage is required. This method of providing a statement is safe from Covid-19 exposure and securely reaches the intended recipient directly.

This feature allows for the sending of emails to All or Groups of members/Customers. Recipients are Bcc and the Sender can compose the email content within their email client (Outlook, Gmail etc) or Emortelle's in-built email client screen before sending. This feature is excellent for emergency notifications.

Institutions can choose to send text message to All or selected members/customers. Messages are constructed in the module interface and sent via a SMS Modem device from your preferred mobile provider to your members/customers.

The feature sends Alert Notifications via email to members/customers when payrolls are processed, ATM or POS transactions are effected unto their account. This increases the member/customer confidence that they will be notified if such activity takes place on their account.

In keeping with Emortelle's paperless environment, this feature allows for the scanning and digital storage of members/customers documents archived to their accounts. Additionally, the institution can store company documents and append an access level to each so intended users with appropriate access level may retrieve.

This feature allows for digital receipts management where using a signature pad device, an electronic signature will be captured from the member/customer to sign the digital receipt. The receipt will then be automatically emailed to the member. This feature reduces the need for paper and printer as well as physical contact.

© Copyright 2026 MSD